Loan Information

DSR: Here's How To Calculate Your Debt Service Ratio In Malaysia!

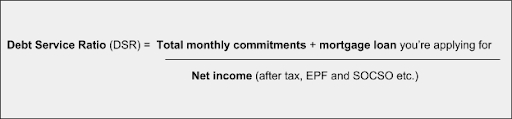

We all know applying for a loan isn’t the most straightforward thing. Everything from your credit history to your job type (sorry, freelancers) is taken into account.And above all, loan officers can be very strict when it comes to scrutinizing these factors. One of the first things your bank will look at it is your Debt Service Ratio (DSR).

If you’ve tried applying for a car or home loan, you probably have a rough idea of what it is, or at the very least, that it plays a major role in whether your loan is approved or not.

What Is Debt Service Ratio (DSR)?

How Do You Calculate DSR?

| Gross Income (Basic salary + Fixed allowance) | RM7,000 |

| EPF Deduction | RM550 |

| SOCSO Deduction | RM50 |

| Tax Deduction | RM400 |

| Monthly Net Income | RM6,000 |

Total Monthly Commitments:

| Personal Loan | RM1,200 |

| Car Loan | RM800 |

| PTPTN Loan | RM200 |

| Credit Card | RM300 |

| Total Monthly Commitments | RM2,500 |

DSR (without new housing loan): (RM2,500/RM6,000) x 100% = 41.7%

With new housing loan repayment of RM1,200:

DSR (with new housing loan): (RM3,700/RM6,000) x 100% = 61.7%

Where Can I Find Records Of My Monthly Commitments?

What Affects My DSR?

How Can I Improve My DSR?

- Either reducing your debt or increasing your net income. So start rushing to pay off big-ticket debts!

- You can also consider consolidating your debt for unsecured loans (not tied to any collateral) like PTPTN and credit card bills. This is an easier way to manage all your debt and might actually even help you save on interest.

There’s Another Factor You Need To Consider – Affordability!

My Loan Application Was Rejected. What Do I Do?

Now You Know How To Breeze Through Getting A Home Loan!

- Try to maintain your DSR within the 30-40% range. For individuals, the lower your DSR, the better.

- Find out what the bank’s maximum allowable DSR limit is before applying. You’ll save yourself (and the bank!) a lot of time and money.

- Your DSR isn’t the only thing the banks will look at. Keeping a good credit score is just as important as well.

- Debt isn’t necessarily the devil. Banks are just as wary of individuals with zero liabilities. You can get started by applying for a credit card but do ensure you make prompt payments!

Memorandum Of Transfer (MOT) And 4 Important Documents In Malaysia

What Is MOT And DOA?

What Are The Steps In Transfer of Ownership?

1) Home Loan And Lawyer Up

2) Letter Of Offer (LO)

3) Sale And Purchase Agreement (SPA)

4) Facility Agreement

5) Memorandum Of Transfer / Deed of Assignment

Why Is Having A Lawyer Important When Buying Property?

- Ensure everything runs smoothly

- Making sure things like documents are stamped

- Legal requirements are fulfilled within the right time frame

- All sorts of other little miscellaneous things you’d never know to check

What Does Stamp Duty Have To Do With The Memorandum Of Transfer And Deed of Assignment?

What Are The Costs Associated With Each Stage of Buying A Property?

1) Loan Agreement

| Loan Amount | Legal Fees Charge |

| First RM500,000 | 1% (minimum RM500) |

| Subsequent RM500,000 | 0.8% |

| Subsequent RM2 million | 0.7% |

| Subsequent RM2 million | 0.6% |

Subsequent RM2.5 million Excess of RM7.5 million | 0.5% Negotiable on the excess (but shall not exceed 0.5% of such excess) |

2) Letter Of Offer

This is usually the point where an earnest deposit comes into play. That’s 2% of the total value of the property, and counts towards the overall 10% down payment.

The earnest deposit is usually non-refundable.

3) SPA

Signing the SPA is when the big money payments begin. At this point, the full 10% down payment will be required. Any earnest deposit already paid will count towards this total.

This will also require payment of the SPA’s legal fees.

| House Price | Legal Fees Charge |

| First RM500,000 Subsequent RM500,000 | 1% (minimum RM500) 0.8% |

| Subsequent RM2 million | 0.7% |

| Subsequent RM2 million | 0.6% |

Subsequent RM2.5 million Excess of RM7.5 million

| 0.5% Negotiable on the excess (but shall not exceed 0.5% of such excess) |

4) Instrument of Transfer: MOT / DOA

| House Price | Stamp Duty Charge |

| First RM100,000 | 1% |

| RM100,001 – RM500,000 | 2% |

| RM500,001-RM1,000,000 | 3% |

| RM1,000,001+ | 4% |

Tip: First time homeowners currently benefit from various government exemptions, which you can find out more about on our stamp duty guide.

Stamp Duty and Legal Costs For Purchase Of Property

Example of Total Stamp Duty Calculation | ||

Stamp Duty for Loan Agreement Legal Fees for Loan Agreement | A fixed rate of 0.5% on the loan amount 1% on first RM500,000 of loan amount 0.8% on subsequent RM200,000 | = RM3,500 = RM5,000 = RM1,600 |

Stamp Duty for SPA Legal Fees for SPA | RM10 for each copy x 4 copies 1% on first RM500,000 0.8% on subsequent RM300,000 | = RM40 = RM5,000 = RM2,400 |

| Stamp Duty for MOT / DOA | 1% on first RM100,000 2% on subsequent RM400,000 3% on subsequent RM300,000 | = RM1,000 = RM8,000 = RM9,000 |

Total Stamp Duty and Legal Costs Involved | RM35,540 | |

Stamp Duty Exemptions In 2020/2021

1) Stamp Duty Exemptions for First-Time Homebuyers

- For first-time homebuyers only

- Property worth not more than RM500,000

- This exemption is for the Sale and Purchase Agreement completed between January 2021 to 31 December 2025

2) Stamp Duty Exemptions under the Home Ownership Campaign (HOC) 2020/2021

Full Stamp Duty Exemption on MOT and Loan Agreement

- For residential homes priced between RM300,000 to RM2.5 million

- Subject to a minimum 10% discount by the developer

- Exemption on MOT is limited to the first RM1 million of the property price.

Full Stamp Duty Exemption on Loan Agreement

- Applicable for loan agreements effective for Sale and Purchase Agreements (SPA) signed between 1 June 2020 to 31 December 2021.

How About Closing Costs When Buying A Property?

1) Real Property Gains Tax (RPGT)

2) Legal fees

6) Home renovation and refurbishments

What Does A Transfer Of Love In Property Mean?

Applying For A Housing Loan In Malaysia: 6 Important Things To Know!

1) What’s An Interest Rate?

1(a) Fixed Interest Rate

1(b) Variable Interest Rate

2) The Type Of Loan You’re Getting

2(a) Term loan

2(b) Semi-Flexi loan

2(c) Flexi loan

3) Lock-in Period

- Full settlement

- Refinancing

- Selling your property

RM400,000 x 3% = RM12,000

4) Your Margin Of Finance

(90% x 750,000) = RM675,000

- The type of property you’re purchasing

- The location of that property

- Your age

- Your income

5) Legal Fees And Stamp Duty Charges

- Legal fees for the loan agreement: 1% for first RM500,000 of the loan, 0.8% for the next RM500,000, and 0.5% – 0.7% for subsequent amounts.

- Stamp duty for the loan agreement: 0.5% of the loan amount.

- Legal disbursement fee for the Facilities Agreement (FA): Typically a few hundred Ringgit.

6) The Bank You’re Getting A Loan From

- Do you already have an existing savings or current account with the bank? If you do, it makes money transferring easier.

- Does the bank have a good reputation?

- Is the bank’s overall service satisfactory?

- Do you consider the bank reliable and trustworthy?

- Is there a branch of this bank located near your home or office?

- Does the bank have good online banking facilities?

- Does the bank offer any additional value-added services to make things easier for you?